Why are Venture Capitalists Investing Heavily in Web3

Before we answer the "Why", the question could be "How do Venture Capitalists (VC) make Money on their investments. Whilst details can be found here, here's a quick synopsis:

Typically, in an equity based investment, the return on investment can be a long, arduous journey, which could be in form of startups going public (IPO), possibly being acquired, or worse case, failed investment. The time horizon for these events could last from 4-6 years, or sometimes even longer. This also leads to capital tie up and illiquidity. Yes, there are secondary markets for private stock exchange and buy-outs from investors, but the process is complex in itself.

Now Let's talk about the "Why":

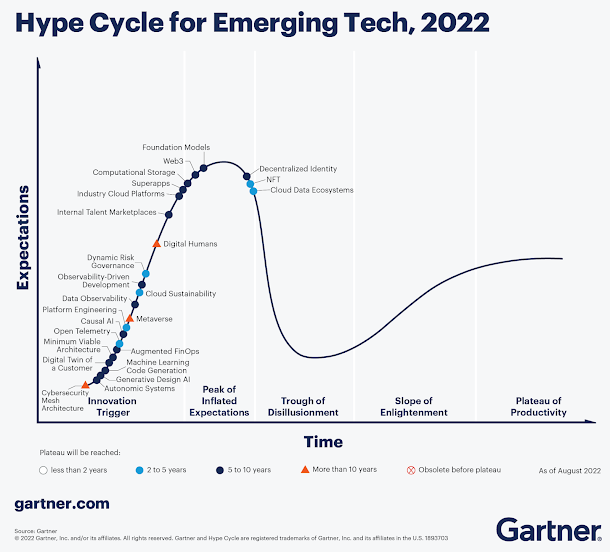

Web3 is an evolution of technology, that is driven by many factors, such as blockchain, tokens, NFT's, DeFi, DAO, security, transparency and the list goes on. According to Gartner Hype Cycle for Emerging Tech, 2022; Web3 is a new stack of technologies for the development of decentralized web applications that enable users to control their own identity and data. Below it can be seen that Web3 will reach apex 5-10 years, which aligns with our predictions as well.

Faster conversation from Illiquid to Liquidity:

What is enticing to the investors is that most Web3 projects issues tokens. These tokens are available to exchange on different marketplaces such as Coinbase quite quickly. So, the illiquidity aspect of traditional investment, along with time-horizon, is suddenly evaporating. Furthermore, if the token strikes a cord with consumers, think Bored Ape, the investment can reach multiples (10-100X+), at a much higher pace, allowing a return on investment much sooner, assuming there are no-lock periods.

Transparency to Startup Metrics:

Taking it further another step, startup metrics, investments burn-rate, run-rate, run-way are usually measured and showcased in a very traditional "forecast" manner i.e forward looking statements. The investors, in traditional startups, therefore bet on future cash flows. Web3, where startups issues tokens, use blockchain, implying startup metrics are quite transparent, including the usual metrics related to capital allotment and usage. Investors can therefore quickly assess which direction the startup is heading in.

Additional Revenue Stream using Tokens:

Inventors, typically have to wait for a significant event to reap the rewards, as motioned previously. With token, there are opportunities to generate passive income, without risking the existing investment. There are several levers to do so:

- Liquidity Mining: Provide liquidity to a DeFi protocol and earn rewards

- Stake Tokens: Committing assets in a proof-of-stake scenario to earn additional tokens

- Yield Farming: Earn interest by pooling tokens in a pool

I'm Not Sold, There Have to be Risks:

If been a skeptic reader so far, you're probably thinking about risk. Like every investment there are risks, even in traditional investment model. The risks associated with Web3 investments, are similar and different to traditional risks. Top of the list of course is that there is no product/market fit and the token simply fades. Going down the list, security is a concern, especially with an influx in how digital wallets have recently been breached. Regulations are another risk, as the government could implement enact a new law that changes the token landscape completely.

Final Takeaways then?

As the technology evolves, there will be new ways for investors to find opportunities. Let's not forget SPAC was a big thing a few years ago and it's still around. Whilst, it is not a norm, just like Token or Web3, it's a lever that investors used and continue to use to get a faster return on their investment. Also, Ether merger is now imminent, possibly allowing it to eclipse Bitcoin and stable coins, so options keep on presenting themselves.

0 Comments