|

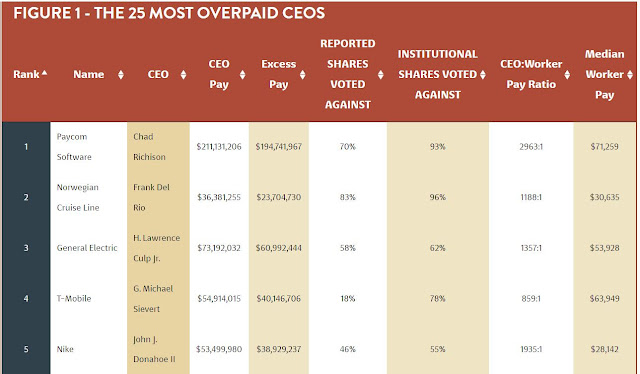

Source: As You Sow 2021 CEO Salary ReportTop 10 List of the Most Overpaid CEOs in America |

Video summary of the article:

As You Sow, a non-profit shareholder advocacy organization, has been publishing the list of over paid CEO's since 2015. Ever since the report first came out, a hypothetical rolling portfolio of each new year’s 100 most overpaying firm would have performed 20% worse than if you’d simply invested in an index fund that matched the S&P 500 average. This suggests that maybe overpaying the boss isn’t the most winning business strategy.

It must be pointed out that, As You Sow’s annual report has never simply intended to point out that CEOs earn a lot, rather, it’s to track how the CEO pay is becoming increasingly unaligned with company performance.

Methodology used by As you Sow & Rankings:

To stay un-biased, As you Sow, looks at factors like the percent of shareholders who voted against a CEO’s pay package, how much that CEO’s pay outpaces their company’s performance, and the ratio of the CEO’s pay compared to their average worker’s.

Using these criteria, As You Sow report, published on Feb 23rd, 2022, lists 2021’s top 10 most overpaid executives as below:

- Chad Richison, of Paycom Software

- Frank Del Rio, of Norwegian Cruise Line

- Lawrence Culp Jr., of General Electric

- Mike Sievert, of T-Mobile

- John Donahoe, of Nike

- Chris Nassetta, of Hilton

- John Plant, of Howmet Aerospace

- David Zaslav, of Discovery

- Brian Niccol, of Chipotle Mexican Grill

- Leonard Schleifer, of Regeneron Pharmaceuticals

“There’s never been a year with this number of high opposition votes against pay in the eight years of this report,” says Rosanna Landis Weaver, the report’s lead author. “Some boards acted as if pay for performance didn’t matter when COVID-19 was involved, and shareholders angrily rejected those packages.” But As You Sow argues that it’s time for more shareholders to reject excessive executive compensation simply because it’s “not in the best interests of shareholders,” and perhaps also immoral.

Did you notice that the usual suspects are missing?

Tim Cook, Elon Musk, Jack Dorsey and the likes are missing from the list. Possibly they don't fulfill the As You Sow methodology. Others though are taking action.

Norway's oil fund, the world's largest sovereign wealth fund valued at $1.3 trillion, said on Sunday it will be voting against Apple on pay policies. The disclosure includes one vote that would grant Tim Cool salary and bonuses valued at $99 million.

Elon Musk on the other does not draw a salary as CEO. Let's see how makes the list next year.

0 Comments